Thinking Of Selling Your Business? Start Here.

What to Expect When You’re Ready To Sell

There are several reasons small business owners decide to sell their companies — they want to move to another city or state, sales are down, they’re looking for a new challenge or it’s time to retire.

The prospect of selling your business can feel overwhelming, and you want to receive a fair price for the assets you’ve worked so hard to create. To make the process as easy and profitable as possible, you’ll want to start planning early. Whatever the reason, once you decide to sell, you can’t just hang up a “for sale” sign and wait for the offers to come rolling in. Selling for the right price takes time and preparation.

What’s Your Goal in Selling?

Owners often focus primarily on the question “How much can I get for my business?” However, the first question an owner needs to be prepared to answer is, “What results do I want to get from this transaction?” Business owners will typically focus on what they think their business is worth or how much a peer recently sold their business for, even if that business was in a different industry.

PGP Advisory suggests focusing on the owner’s personal needs and goals. For example, consider these questions:

- Do you want to transition the company to the next generation of your family or to employees?

- Is your goal to find a willing buyer in the open market and maximize the sale price?

- Do you plan to retire and live off of the proceeds from the sale for the rest of your life?

- Are you looking to invest some of your equity with the buyer and work with/for the next owner?

- Are you looking to reinvest in a different opportunity?

- What other goals do you have (e.g., paying for college educations, contributing planned amounts to charity)?

Understanding the Realistic Timeline is Essential

In an ideal situation, the questions above would be asked and answered several years before the owner wants to take their business to market. This timeframe would allow for appropriate estate and investment planning. Plus, having a longer timeframe allows owners and their advisors to consider what actions can be taken to increase the value of the company before going to market and leaves ample time for implementation.

Having time on your side can really pay off when selling a business. Whether you’re ready to retire or simply want to move on to a new venture, it’s imperative to keep in mind, that the completion of a sale can take well over a year, so keep that in mind as you plan your exit strategy.

At PGP Advisory, we explain to our clients that it’s reasonable to prepare for this to be a 2-year process, roughly from the time you decide to sell, all the way to the completion of the sale. Wrapping your head around this realistic time frame is a necessary first step. This critical preparation will help you to improve your financial records, business structure, and customer base to make the business more profitable. These improvements will also ease the transition for the buyer and keep the business running smoothly.

Selling a business requires an enormous amount of planning. As you begin the process, it’s important to focus on the step you’re in and the long-term objective. Otherwise, you may end up making short-term decisions that go against your ultimate plan.

Takeaways

Knowing what you want/need as a result of the sale and understanding the realistic selling timeframe, will set you up as much as possible for a smooth and successful transaction.

In our next segment, PGP Advisory will walk you through the first steps owners will want to take to begin the selling process from an advisor perspective, including helping you construct your transition team.

Read More

Why Your Business Should ALWAYS Be Ready To Sell

Whether you have exit strategies in place or you plan to operate your business for a long period of time, as an entrepreneur, you should always be ready to sell your business. Many owners of private businesses fail to recognize the importance of running their companies in a way that ensures they are fully prepared should the need to sell arise.

Based off experience helping countless business owners reposition and restructure their businesses, PGP Advisory always encourages clients to the adopt the prepared mindset of ‘always be ready to sell,’ even if they have no intention of selling. Our goal today is to demonstrate how always being ready to sell will position your company for success regardless of where you are on your business journey.

Be The Buyer

Let’s begin by placing ourselves in the position of a prospective investor. A savvy business investor will want to see a well-oiled, automated, documented, efficient, and streamlined machine when they look under the hood.

Potential buyers almost always can see through a rushed attempt to make a business seem as though it’s running at its full potential. Failing to put solid financial systems in place or to make sure key management team members are fully capable of leading when you’re not around is like waiting until the week before your child graduates from high school to research college admissions requirements. Simply put, it’s too late.

Most sellers do not consider buyer needs until a sale is imminent, which often results in them scrambling to make changes or accepting a reduced sale price.

Prepare to Sell, Even If You Don’t

Ready to sell, does not mean your business has to be on the market. It means that if a sale arose, or circumstances change, your business will immediately be more attractive to buyers. The intention here is that by being ready to transition to a new owner, putting solid systems in place, employing great staff and reducing reliance on the you as an owner, will inevitably ensure you get the best price when it is time to sell. This also means that it becomes easier to run your business and you can spend more time working on your business instead of in it. At times, forces beyond our control (e.g. COVID-19, economic recessions, difficulty accessing capital, rising rates, etc.) may affect the timing of your decision. Many sellers took advantage of the premium paid by buyers in the seller’s market for businesses over the past few years. It pays “literally” to consider exiting when there is strong demand and favorable conditions for acquiring businesses.

How to Get Started

PGP Advisory suggests beginning the process with properly setting up your business’ documentation. Are your company’s leases and agreements current, secure and available? Insider Tip – Whenever you renegotiate your lease agreement, consider asking the landlord to agree to subordinate if you (or a buyer) decide to seek bank financing. Be sure your business’ financials are in order, are your Profit and Loss Statements, Balance Sheets, and tax returns accurate, easily accessible, and showing positive trends? We also recommend giving serious thought to your company’s systems and procedures- do you have an operational playbook? Take a look at your role within your company and reduce the need for you to be involved on a daily basis as you can delegate to adequate and well-trained staff.

Takeaways

Owners who adopt a prepared mindset receive the dual benefit of a business with higher value to any external buyer, as well as enhanced profits regardless of whether a sale ever occurs. Being ready for a sale, means making your business more attractive to an outside investor and means your business is more prepared for any eventuality outside of your control that may force you into sale. These tips will help you keep your operations in excellent shape, and they will help your company be more nimble and adaptive to change with a stronger foundation to stand on.

Check out the link below to…

Explore Tax and Cost Savings Opportunity

Valuation. Strategy. Results.

At PGP Advisory, we always emphasize the significance of valuation. Even if you have no plans to sell, intentionally adding value is one of the best ways to strengthen your business and protect yourself from unforeseen events. We work with clients in San Antonio, Austin, Atlanta and beyond. No matter where your business is located, life throws curve balls. Our experienced team of professional business brokers in San Antonio, knows what buyers look for in a business. The factors that result in a premium sale price are inherently good for day-to-day business. Our unique advisory service starts with a valuation and business analysis. We identify strengths and weaknesses, then we develop a realistic strategy designed to add value, streamline operations, reduce owner dependency, and increase profitability. We draw on academia, years of experience, and a deep understanding of what makes a well-rounded business broker in San Antonio. Implementing best practices early will result in a more efficient and profitable business that is ready to sell when the time is right. By planning in advance you are much more likely to achieve your financial goals.

- We offer a free automated valuation to get started. You will receive a broad perspective on your business’s potential value. Click here to proceed.

- Click here to schedule your free custom consultation. During this meeting, we’ll be able to provide more comprehensive insights about your business and its current worth.

- PGP Advisory also offers a more robust and detailed valuation model. Click here if you’d like to get started with a more in-depth business valuation that takes into account additional factors, such as your market.

Business valuations can highlight strengths and weaknesses, and expose opportunities for improvements to add value. Many of our San Antonio, Austin and Atlanta clients use their business valuation results to build and help locate new opportunities. Contact us today if you would like to discuss setting up your valuation and the most appropriate option for you.

Read More

What’s In a Number? Must-Have Metrics For Your Business

April Kicks Off Financial Literacy Month

Financial Literacy Month is a nationally recognized campaign to bring awareness to the need for more financial education in schools and for adults. During Financial Literacy Month, financial institutions, nonprofits, and human service agencies increase their focus on the importance of financial literacy through events, programs, and counseling.

We see a goal that goes beyond helping just consumers learn more about finances to helping entrepreneurs actually improve the financial management of their most valuable asset- their business. The result is improved business and personal financial stability and success.

Why Financial Literacy Matters

- Parents rank teaching financial responsibility to their children near the top of their wish list.

- Only a handful of states require high school students to take a personal finance course before graduation.

- Poor financial literacy leads to poor decision-making which leads to poor behavior which limits the household’s ability to reach its financial goals.

- Increased financial literacy will help drive wealth for small businesses and their owners.

The Importance of Business Metrics

Last month, PGP Advisory discussed the importance of incorporating our top 7 value drivers into your business strategy to increase cash flow, as well as reduce risk, thus enhancing the overall value of your company. We established that the valuation process involves an assessment of your company and should be a crucial part of any business owner’s standard operating procedure.

The essential next steps to running a successful business, require a thorough analysis of the work, sales, and financial results. This cannot be done without tracking relevant business metrics. Measuring your organization’s performance requires thorough data collection and analysis. But with countless examples of business metrics, how do you know which ones are worth tracking? The ideal combination of key performance indicators (KPIs) will depend largely on your individual business’ needs.

What Gets Measured – Gets Managed

Business Metrics Every Company Should Know

For all businesses, it is critical to track operational metrics such as output, quality, and productivity on a regular basis. The specific measures will vary from company to company, but your productivity metrics improve operations by highlighting opportunities to standardize work, eliminate waste, and solve systemic problems. The result is happier customers, reduced costs, and a consistent operation that is easier for you (and any future owner of the business) to run.

Gross Margin is one of the most important metrics that an entrepreneur should know. It is crucial to running your business on a day-to-day basis. Gross margin lets you know how much of each sales dollar is available to pay overhead and profit after direct expenses are paid. Many businesses are seeing input costs such as wages, materials, and freight rise. Businesses with strong market positions are often able to adjust pricing to maintain their gross margins.

ROI measures the efficiency of an investment. It can be used to compare different investments made into your business. It is a great way to indicate what is working and what isn’t. For companies looking to grow through acquisition, ROI is a simple metric to compare the relative attractiveness of a potential target.

The current ratio is used to test a company’s liquidity and working capital. The current ratio is the company’s current assets divided by its liabilities. Calculating the current ratio, you will see if your company is readily available to pay its short-term liabilities like taxes, debts, and expenses. A business should keep its current ratio over 1 which means that there is enough working capital for healthy operation. For growing companies, it is an important indicator of whether or not you have sufficient working capital to fuel continued growth.

These two metrics answer the following: How much do you make per customer or lead during its lifetime? How much does it cost to acquire a customer? Knowing your LTV and CAC of your customer is a piece of the crucial information you can obtain. Every dollar of revenue is not equal. Recurring revenue from loyal, “sticky” customers are a valuable asset for your company. CAC and LTV are measures that inform which customers to target, the most effective and efficient sales and marketing approach, and how to ultimately grow more profitably.

The importance of web-analytics can’t be argued in the digital era. Every online business should have a basic understanding of web analytics.

What’s In a Number?

Why should your business be so concerned with metrics? For starters, these metrics are golden tidbits of information and can mean the difference between success and failure. There are many more metrics that exist for your company to track, such as project management metrics. The ones that matter most depend on your specific type of business. For example, if you sell products, tracking your inventory size may be important.

PGP Advisory recommends your company remain judicious in your choice of metrics to track. Business owners can easily become overwhelmed with data or spend too much time just collecting and analyzing rather than using the insights to actively manage your business.

With the appropriate metrics for your company in hand, you can steer your organization in the right director toward achieving your business goals.

Must-Have Value Drivers for a Successful Business

How to Increase Your Business Value Using Value Drivers

Value drivers are characteristics of a business that either reduce the risk associated with owning the business or enhance the prospect that the business will grow significantly in the future. Every business owner should consider these essential factors to increase cash flow, as well as reduce risk, thus enhancing the overall value of the company.

An ongoing assessment of your business’ value drivers is integral to success. Profitability is hugely important, but implementing valuation drivers can result premiums. The valuation process involves an assessment of the company that should be part of any owner’s standard operating procedure, providing meaningful, actionable information highlighting the intrinsic value of your business and ultimately maximize returns.

Top Factors that Increase the Value of Your Business

PGP Advisory recommends incorporating these top seven factors that drive business value beyond revenue.

7 Drivers of Business Value

- Financial Performance – Know your numbers and keep good books and records! Both are critical inputs to operating your business, securing a bank loan to finance growth, sale of your business, and a range of other scenarios. The balance sheet- assets, liabilities, and equity positions- is an indicator of the future health of your company. The profit and loss and cash flow statements indicate the company’s profitability and the sources/uses of cash in the business. A company’s ownership, bookkeeper, and accountant work together to ensure that the financials statements accurately reflect the financial performance of the company. The financial statements tell the “real story” about performance. They give you, as the owner, the data you need to evaluate how much cash your business generates today and a means to assess progress toward your financial goals over time.

- Unique Product and Service Offering – An important factor in company value is your mix of products or services that you offer. Identify what makes your product and service offering unique. It gives you a designated place in the market with a very specific customer base, which is great. But, at the same time, be aware that a lack of diversification can create too much dependence on limited markets and industry shifts. Key customers may seek out suppliers who offer a range of products that benefit them. Increasing diversification and vertical or horizontal integration lowers risk, which boosts value.

- Solid Customer Base – Having a customer base that is established, loyal and widespread is important for the continuing viability of a company. As you grow your businesses, be intentional about not putting all your proverbial eggs into the basket of a few customers. This creates a dependency that in the best case reduces your ability to negotiate favorable terms and in the worst case can result a catastrophic loss of revenue. Successful businesses do not try to be everything to every customer. In your strategic plans, identify the customers and customer segments where you want to grow. Be intentional with growth across different customers and customer segments that see value in your offering and that you can serve profitably.

- Talent – Can your business run without you for several weeks? Are you involved in day-to-day tactical execution? Skilled human capital is vital for any organization. A business with strong leadership and a capable team are more valuable to the existing (and future) owner. Company employees contribute skills, creative abilities, experience, and knowledge to the business as well as the health of the company’s culture. They significantly reduce the risk and reliance of the business of the owner, freeing up time to focus on growth or other interests and supports a smoother transition for the next owner when the time comes.

- Technology – Technology enables efficient ways to connect with customers and clients. It makes the business adaptable. Invest in technology that help you better understand and serve the ever-changing needs of your customers. It can also drive operational efficiencies in all aspects of the business, driving down costs and facilitating growth.

- Sales and Marketing Strategy – Marketing refers to the link between the needs of customers and their response to the products or services of a company. A company with strong branding will improve its sales through an increase in market recognition and also give it a clear direction that helps enhance operational efficiency. A company should tie its brand to its mission and strategy direction and be aware of its sales and marketing shortcomings and capabilities. Word of mouth is not a marketing strategy. Be intentional in your efforts to communicate your unique offering to your target market of customers. Over the lifetime of every business, customers will come and go. A strong Sales and Marketing strategy is necessary to sustain and grow enterprises over time.

- Strategic Vision – Strategy involves a choice of how your company will compete in the market place. The company’s management needs to develop a good understanding of the impact of economic factors on their industry, their market share and market position, and their unique and niche offering. The people, processes, technology, marketing approach, financing, etc. should be organized to position your company to win in the marketplace. Focus on who you want to serve, how you want to serve them, and how you do that profitability. Strategy is not a presentation that sits on a shelf, but a living approach to how your company plans to succeed in the years to come.

Understanding Valuation Drivers – Key Takeaways

For your company to remain successful, you should always be monitoring the health of your key value drivers. Value drivers will make a business seem better than its competitors’. By creating as many value drivers as possible, a company can boost its leverage on the marketplace.

Check out these additional resources regarding value drivers:

Employee Retention Credit Info

Drive Your Profitability Through Cost Reductions

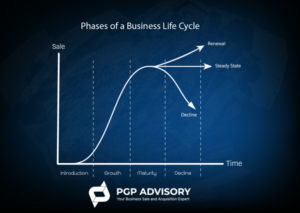

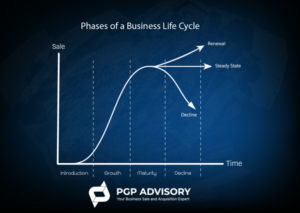

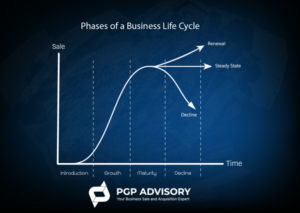

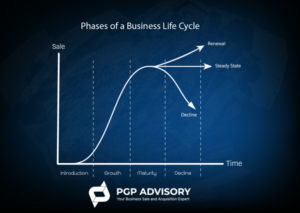

PGP Advisory remains steadfastly committed to guide you through your business journey for 2022 and beyond. No matter which phase of the business life cycle you find yourself. If you would like to explore more options for growing your business in the San Antonio, Georgia or North Carolina area, our M&A experts and business brokers at PGP Advisory are here to help.

Can you identify where your business lands in the life cycle chart?

More to come in the upcoming months to help you navigate challenges and circumstances your business may encounter.

Ready to explore your growth options or perhaps discuss your exit strategy? Contact PGP Advisory Today.

PGP Advisory is a full-service business brokerage and M&A advisory firm and a leader in business sales & acquisitions. PGP Advisory specializes in the CONFIDENTIAL sale of privately-owned businesses in a wide range of industries. Our business advisors are highly respected, experienced advisors who are recognized as some of the top deal makers in the business brokerage and M&A industry. We serve business owners throughout the San Antonio and Austin, Texas areas, as well as Atlanta, GA and Charlotte, NC.

Our M&A advisors and experienced business brokers have first-hand experience dealing with the challenges and opportunities of owning, selling, or merging a business. These qualities are what drive us toward continued excellence and set us apart from the competition.

Are you ready for a free confidential valuation? Your initial business valuations serve as a benchmark toward your next steps.

Click here for more information.

San Antonio | Austin | Atlanta | Charlotte

Read More