What’s In a Number? Must-Have Metrics For Your Business

April Kicks Off Financial Literacy Month

Financial Literacy Month is a nationally recognized campaign to bring awareness to the need for more financial education in schools and for adults. During Financial Literacy Month, financial institutions, nonprofits, and human service agencies increase their focus on the importance of financial literacy through events, programs, and counseling.

We see a goal that goes beyond helping just consumers learn more about finances to helping entrepreneurs actually improve the financial management of their most valuable asset- their business. The result is improved business and personal financial stability and success.

Why Financial Literacy Matters

- Parents rank teaching financial responsibility to their children near the top of their wish list.

- Only a handful of states require high school students to take a personal finance course before graduation.

- Poor financial literacy leads to poor decision-making which leads to poor behavior which limits the household’s ability to reach its financial goals.

- Increased financial literacy will help drive wealth for small businesses and their owners.

The Importance of Business Metrics

Last month, PGP Advisory discussed the importance of incorporating our top 7 value drivers into your business strategy to increase cash flow, as well as reduce risk, thus enhancing the overall value of your company. We established that the valuation process involves an assessment of your company and should be a crucial part of any business owner’s standard operating procedure.

The essential next steps to running a successful business, require a thorough analysis of the work, sales, and financial results. This cannot be done without tracking relevant business metrics. Measuring your organization’s performance requires thorough data collection and analysis. But with countless examples of business metrics, how do you know which ones are worth tracking? The ideal combination of key performance indicators (KPIs) will depend largely on your individual business’ needs.

What Gets Measured – Gets Managed

Business Metrics Every Company Should Know

For all businesses, it is critical to track operational metrics such as output, quality, and productivity on a regular basis. The specific measures will vary from company to company, but your productivity metrics improve operations by highlighting opportunities to standardize work, eliminate waste, and solve systemic problems. The result is happier customers, reduced costs, and a consistent operation that is easier for you (and any future owner of the business) to run.

Gross Margin is one of the most important metrics that an entrepreneur should know. It is crucial to running your business on a day-to-day basis. Gross margin lets you know how much of each sales dollar is available to pay overhead and profit after direct expenses are paid. Many businesses are seeing input costs such as wages, materials, and freight rise. Businesses with strong market positions are often able to adjust pricing to maintain their gross margins.

ROI measures the efficiency of an investment. It can be used to compare different investments made into your business. It is a great way to indicate what is working and what isn’t. For companies looking to grow through acquisition, ROI is a simple metric to compare the relative attractiveness of a potential target.

The current ratio is used to test a company’s liquidity and working capital. The current ratio is the company’s current assets divided by its liabilities. Calculating the current ratio, you will see if your company is readily available to pay its short-term liabilities like taxes, debts, and expenses. A business should keep its current ratio over 1 which means that there is enough working capital for healthy operation. For growing companies, it is an important indicator of whether or not you have sufficient working capital to fuel continued growth.

These two metrics answer the following: How much do you make per customer or lead during its lifetime? How much does it cost to acquire a customer? Knowing your LTV and CAC of your customer is a piece of the crucial information you can obtain. Every dollar of revenue is not equal. Recurring revenue from loyal, “sticky” customers are a valuable asset for your company. CAC and LTV are measures that inform which customers to target, the most effective and efficient sales and marketing approach, and how to ultimately grow more profitably.

The importance of web-analytics can’t be argued in the digital era. Every online business should have a basic understanding of web analytics.

What’s In a Number?

Why should your business be so concerned with metrics? For starters, these metrics are golden tidbits of information and can mean the difference between success and failure. There are many more metrics that exist for your company to track, such as project management metrics. The ones that matter most depend on your specific type of business. For example, if you sell products, tracking your inventory size may be important.

PGP Advisory recommends your company remain judicious in your choice of metrics to track. Business owners can easily become overwhelmed with data or spend too much time just collecting and analyzing rather than using the insights to actively manage your business.

With the appropriate metrics for your company in hand, you can steer your organization in the right director toward achieving your business goals.

Celebrate 2021 & Look Ahead to 2022 With PGP Advisory

Taking Your Business to the Next Level

We unlock value for owners by helping you prepare for and successfully sell your business. We guide entrepreneurs through the exit process from evaluating options through closing the transaction. PGP Advisory also advises individuals and businesses seeking to grow through acquisition. We are an M&A Advisory firm and Business Broker in San Antonio who works with clients of various sizes across a wide range of industries and geographies. We are excited to support your 2022 exit or acquisition goals!

Looking Back on 2021

Thank you for your contribution toward our success last year. Here’s a summary of what we accomplished:

Crushed Goals in 2021

- Software Consulting Firm Acquisition (Sell-Side Advisor)

- FedEx Trucking Acquisition (Buy-side Advisor)

- Kickboxing Gym Acquisition (Sell-side Broker)

- Flower Store Acquisition (Sell-side Broker)

Total Closed Deal Value: $2.3M

Increased Our Scope

- Executed a strategic partnership with Transworld Business Advisors of Atlanta Peachtree to provide brokerage services in the Georgia market.

- In negotiations with a strategic partner to support M&A Advisory work in Charlotte, NC.

- Working with a partner who assesses business cost-out opportunities. Click here to learn more.

We Remain Committed to:

- Supporting clients through successful merger and acquisition transactions.

- Educating and preparing business owners for successful exits.

- Connecting owners with the resources to increase cash flow and the value of their businesses.

Hyper-Focused on Challenges Ahead

PGP Advisory is here to help you navigate the M&A landscape in the face of obstacles, such as:

- Talent retention in a tight labor market.

- Product availability during supply chain disruptions.

- Input costs and margins in an inflationary environment.

- Debt levels, capital investments, and available deal capital amidst rising interest rates.

Your Business Journey

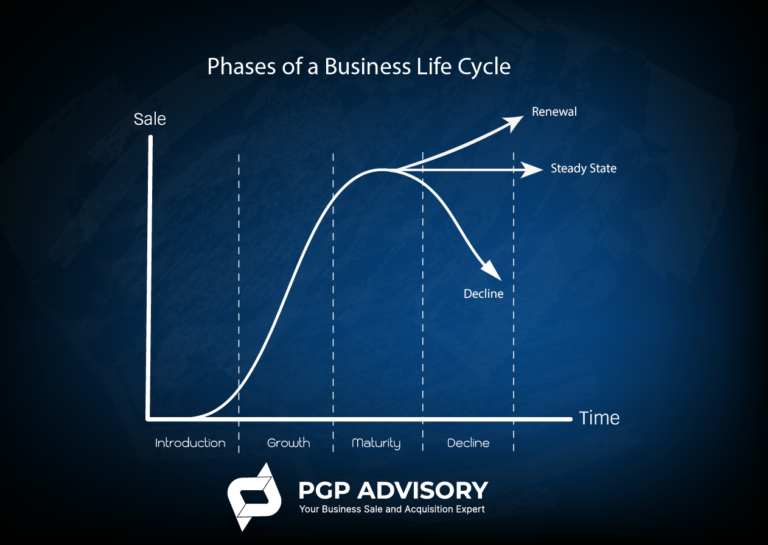

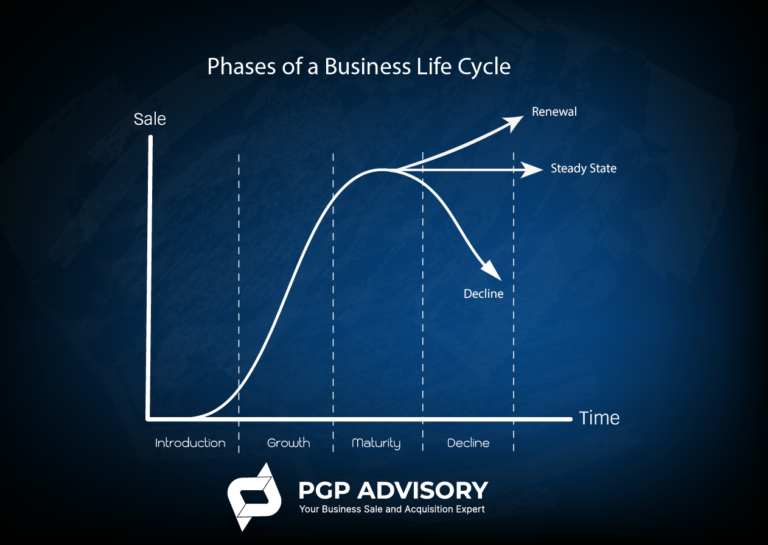

Regardless of where you are in your business journey (growth, maturity, exit), it’s important to focus on increasing the value of your business (i.e. growing operational cash flow). It is the lifeblood for growth, the discretionary income to support personal expenses, retirement, etc., and the driver of your business’ exit value.

Can you identify where your business lands in the life cycle chart?

More in Store for 2022

Be on the lookout for more content from us. PGP Advisory will continue to keep you informed on trends, information and challenges that impact your business. Let our team of trusted advisors help you crush your business goals this year and beyond.

Interested in learning more about the sale process? Download a free white paper here.

Schedule a consultation for your business valuation here.

Read More

What is Your Big Why?

Several years into my career, I realized it was increasingly daunting to live according to my values across what felt like the increasingly independent worlds of a corporate career, family, and community. I took some time to reflect and draft a Life Plan with an aspiration to align the various dimensions of my life to a central life’s mission-

“To be a living testimony to the glory of God by transforming the lives of others while continually striving to be the best man I can be.”

The mission encapsulated my intentions around daily choices on what was important, the types of quality of interactions with others, and served as a north star when faced with conflicting or tough decisions. It became my Big Why? Did my actions today positively impact others or improve me? In the years that followed, I was amazed at how consistent focus on a concept caused it to manifest in my life.

Six years ago, the demands of two young children and a dual career household propelled me into entrepreneurship and PGP Advisory was born. Although it wasn’t planned, the change put me on a pathway to align my priorities, gain greater autonomy over my time, and increase the transformative impact. I created more value for clients while being present for my kids during their formative years. I wanted to be an entrepreneur from my first entrepreneurial program at MIT in High School. The pathway to this destination was not linear, predictable, or easy. The Big Why helped me connect the dots between a Mechanical Engineering degree, an MBA, and a breadth of business experiences with a fulfilling profession.

Why is the Big Why important for you in a business transaction? It ultimately drives the priorities around the outcomes and informs the business transaction strategy. If a seller is unclear about what’s next for her or him, it is more difficult to make trade-offs in a deal. The strategy helps define sources of value and uncovers the win-win-win scenarios for a seller, buyer, and the business- an important tool when navigating the minefield of issues that can kill a deal. Here are some of the Big Why’s from previous clients:

- A client moved to their desired destination and started a new business with the deal proceeds

- A client pursued a new career in healthcare after sale of their business

- A client was able to retire and enjoy free time with family

- A client was able to secure the financial future of his family and focus on aspects of work that were most fulfilling

- A client acquired a business to run and grow as part of the long-term strategy towards wealth creation for his family

Not only did my clients in these deals win, but the businesses won also. They buyers all had sound strategies to improve and grow these businesses which is good for them, employees, customers, the community, etc. The deals supported everyone’s pursuit of her/his own personal Big Why.

Deals are ultimately about people and positive outcomes. I get to bring all of me to work every day in an effort to transform the lives of my clients and in the process live out my life’s purpose.

Read MorePGP Advisory’s Software Implementation Client- Westward Consulting- Completes Sale

PGP Advisory, a leading mergers and acquisition advisory practice and San Antonio business broker, is pleased to announce that it served as the exclusive M&A advisor to Westward Consulting LLC, a strategic Ultimate Kronos Group workforce software implementation partner, in its sale to Mosaic Consulting Group on July 1. With this acquisition, Mosaic Consulting Group, a long-time Ultimate Software partner focused on human capital management (HCM) support and service, is adding Westward Consulting’s Kronos experience and focus on workforce management, to their services.

“We worked with John West, Founder and CEO of Westward, over the past few years to prepare his company for this significant milestone. The cultural fit of the combined organization paired with enhanced solutions offerings into the marketplace position Mosaic to create and deliver increased value to its clients, employees, and partners.” Jason Brown, Managing Partner, PGP Advisory

John West, Westward CEO adds, “This is an exciting time. Two best-in-class teams are coming together to offer a full suite of services to our clients. Now, we will be able to help our clients seamlessly optimize and hone their team related strategy, processes and technologies”

Westward Consulting was founded in 2015 as a workforce consulting company with a mission that guides organizations to exceptional workforce performance. The Westward team exemplifies their team’s values: Family, Ethical, Fun and Generous. They deliver an exceptional client experience by focusing on thinking outside the box. Finding innovative solutions for their clients is at their core.

About PGP Advisory

PGP Advisory is a M&A advisory firm that helps our clients create value in the transaction process by offering Fortune 500 experience, tools, and strategies to small and midsized businesses. We seek out, identify, and solve problems for our clients throughout the entire transaction process. We leverage both our deal and operational expertise and experience to support our clients’ desired deal outcomes.

Strategic Planning Lesson from Game of Thrones

“Fight every battle, everywhere, always, in your mind. Everyone is your enemy, everyone is your friend, every possible series of events is happening all at once. Live that way and nothing will surprise you. Everything that happens will be something that you’ve seen before.” Petyr Baelish, Game of Thrones.